Ethereum Binance Bridge A Gateway To Cross-chain Finance

Ethereum Binance Bridge is the bridge that connects two major players in the blockchain space, Ethereum and Binance Smart Chain. It enables users to seamlessly transfer assets across these networks, enhancing the flexibility and accessibility of decentralized finance. With the rising demand for cross-chain transactions, understanding this bridge is crucial for anyone looking to maximize their blockchain experience.

In this overview, we'll explore the fundamental concepts of both Ethereum and Binance, delve into the technical workings of the bridge, and highlight its key features and benefits that make it an essential tool for cryptocurrency users.

Introduction to Ethereum and Binance Bridge

Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). It plays a crucial role in the blockchain ecosystem by providing a programmable environment that facilitates various use cases, from finance to gaming. The Ethereum network operates on its own cryptocurrency, Ether (ETH), which is used to power transactions and computational tasks within the ecosystem.The Binance Bridge serves as a vital tool for facilitating cross-chain transactions between Ethereum and Binance Smart Chain (BSC).

Its primary purpose is to allow users to transfer tokens seamlessly between these two networks, enhancing liquidity and accessibility. By connecting different blockchain ecosystems, the Binance Bridge promotes a more interconnected crypto landscape.Key features of the Ethereum Binance Bridge include fast transaction speeds, low fees, and the ability to support a variety of tokens. These benefits empower users to move their assets quickly and efficiently, making the bridge an essential component of modern blockchain interactions.

Technical Overview of the Ethereum Binance Bridge

The Ethereum Binance Bridge operates on a sophisticated technical framework that utilizes blockchain technology to ensure secure and efficient asset transfers. At its core, the bridge employs smart contracts that automate the process of locking, minting, and releasing tokens across the two chains. Smart contracts on Ethereum handle the locking of the original asset when a user initiates a transfer.

Once locked, an equivalent amount of the asset is minted on the Binance Smart Chain, allowing users to access their funds in a different network without losing ownership. Security measures are paramount in this process, and the bridge implements various protocols to protect user assets during transactions. This includes encryption, regular audits, and the use of multi-signature wallets to guard against unauthorized access and ensure safe transfers.

How to Use the Ethereum Binance Bridge

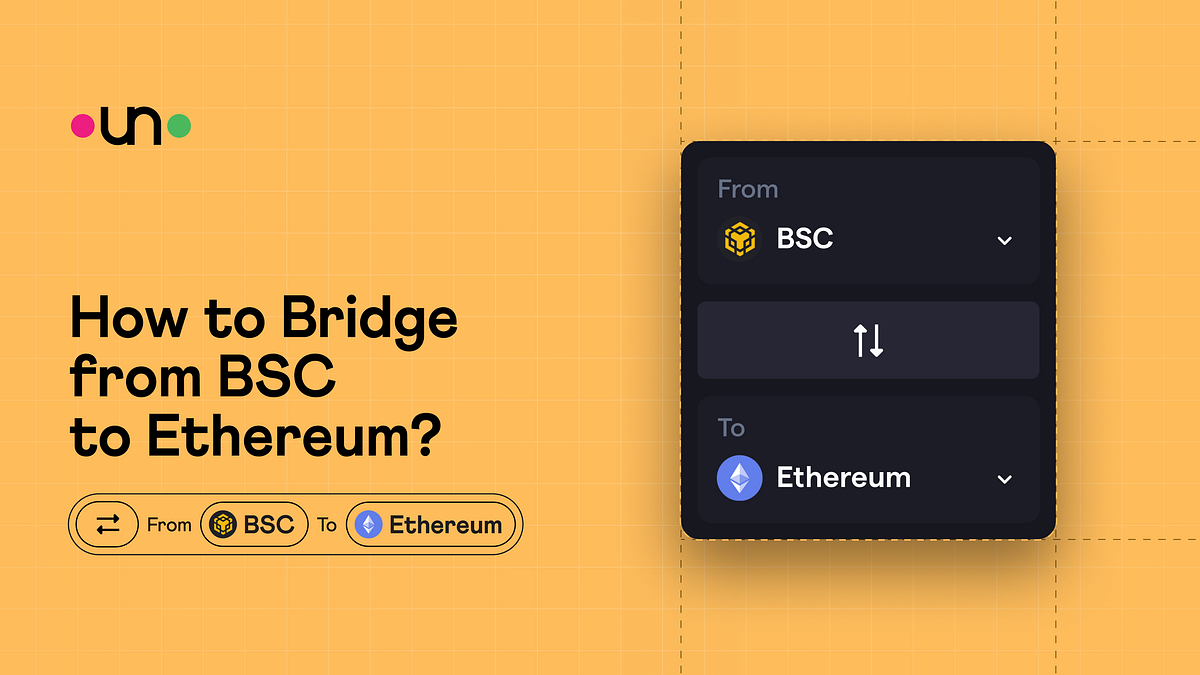

Initiating a transfer using the Ethereum Binance Bridge is a straightforward process. Here’s a step-by-step guide to help users navigate through it:

- Connect your wallet (e.g., MetaMask) to the Ethereum network.

- Visit the official Binance Bridge website.

- Select the asset you wish to transfer from Ethereum to Binance Smart Chain.

- Specify the amount and confirm the transaction in your wallet.

- Wait for the transaction confirmation; the equivalent tokens will be minted on BSC.

The bridge supports a wide range of tokens for transfers. Some of the popular ones include:

- Ethereum (ETH)

- Binance Coin (BNB)

- USD Coin (USDC)

- Wrapped Bitcoin (WBTC)

- ChainLink (LINK)

While using the bridge is generally smooth, users may encounter common issues. A troubleshooting section for these could include:

- Transaction delays: Ensure your network connection is stable.

- Token not appearing: Refresh your wallet or check the token settings.

- Error messages: Review the transaction details and try again.

Advantages of Utilizing the Ethereum Binance Bridge

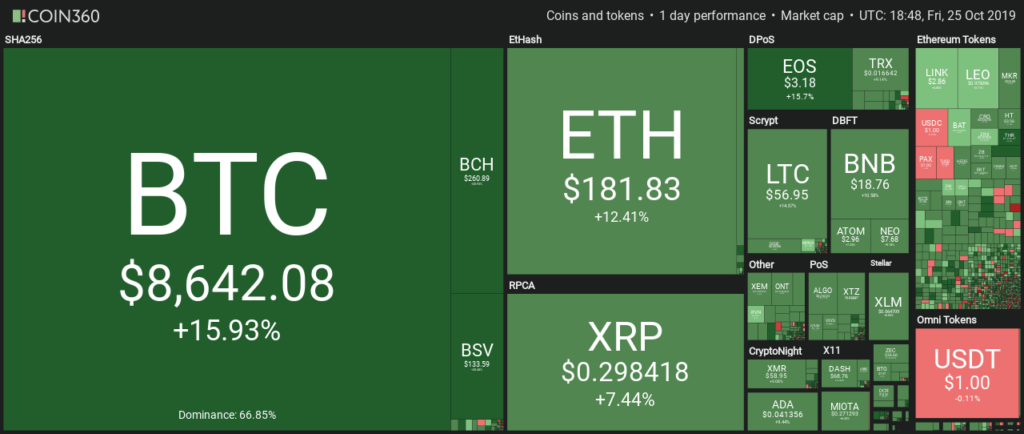

The Ethereum Binance Bridge offers numerous advantages that enhance cross-chain interoperability in the blockchain space. One of the primary benefits is the ability to access a broader range of decentralized applications across both Ethereum and Binance Smart Chain, thus maximizing user options.In terms of transaction times and fees, utilizing the bridge is often more efficient compared to traditional methods. Users can expect faster confirmation times and lower fees, which are critical in fast-paced trading environments.Several scenarios exemplify the benefits of the Ethereum Binance Bridge, including:

- Quickly moving assets to take advantage of arbitrage opportunities.

- Accessing different DeFi protocols on either blockchain without excessive fees.

- Participating in liquidity pools across both networks.

Use Cases of the Ethereum Binance Bridge

The Ethereum Binance Bridge is actively utilized in decentralized finance (DeFi) applications, where users transfer assets to take advantage of yield farming and liquidity mining opportunities. Several case studies illustrate successful transactions, such as users moving ETH to BSC to provide liquidity in popular decentralized exchanges like PancakeSwap. These transactions demonstrate the practical utility of the bridge in optimizing asset deployment across networks.As blockchain technology continues to evolve, potential future use cases for the Ethereum Binance Bridge may include:

- Enhanced integration with emerging DeFi platforms.

- Cross-chain NFT marketplaces that require asset transfers.

- Collaborative projects between Ethereum and Binance Smart Chain developers.

Challenges and Limitations of the Ethereum Binance Bridge

Despite its benefits, using the Ethereum Binance Bridge does come with certain risks and challenges. Users must be aware of the potential for smart contract vulnerabilities, which could expose assets during transfers.Additionally, there are limitations regarding transaction volume and the number of supported tokens. Users may find that not all tokens available on Ethereum are transferable to BSC, which can restrict trading options.Regulatory challenges also loom over cross-chain bridges, as varying jurisdictions may impose different compliance requirements.

This uncertainty might affect operational practices as regulations evolve.

Future Developments and Innovations

Looking ahead, several exciting developments are on the horizon for the Ethereum Binance Bridge. Upcoming features may include enhanced user interfaces and increased support for more tokens, which will further streamline the transfer process.Ongoing projects are focused on enhancing cross-chain functionality, such as implementing layer-2 scaling solutions to improve transaction speeds and reduce costs. Experts suggest that the future landscape of blockchain interoperability may see a rise in bridges that will connect multiple networks, creating a more cohesive ecosystem where assets can flow freely without barriers.

Final Wrap-Up

In summary, the Ethereum Binance Bridge stands as a pivotal innovation within the blockchain ecosystem, facilitating smoother cross-chain transactions and enhancing user experience. As the technology continues to evolve, keeping an eye on its developments will be essential for leveraging its full potential in the world of decentralized finance.

Question Bank

What is the Ethereum Binance Bridge?

The Ethereum Binance Bridge is a platform that allows users to transfer tokens between Ethereum and Binance Smart Chain seamlessly.

Is it safe to use the Ethereum Binance Bridge?

Yes, the bridge employs robust security measures, including smart contracts and protocols to safeguard user assets during transactions.

What tokens can I transfer using the Ethereum Binance Bridge?

A variety of tokens are supported for transfers, including popular cryptocurrencies such as ETH and BNB, among others.

Are there any fees associated with using the bridge?

Yes, users may incur transaction fees, though they are generally lower compared to traditional cross-chain methods.

Can I use the Ethereum Binance Bridge for large transactions?

While the bridge supports various transaction volumes, users should be mindful of any limits imposed for specific tokens.