Bitcoin Ethereum Crypto Market Analysis Insights And Trends

Delving into bitcoin ethereum crypto market analysis reveals a fascinating landscape where digital currencies are reshaping the financial world. As cryptocurrencies continue to gain traction, understanding their evolution from Bitcoin to Ethereum and the impact of decentralized finance (DeFi) becomes crucial for investors and enthusiasts alike.

This analysis not only explores the technical foundations of Bitcoin and Ethereum but also discusses the current market trends, investment strategies, and the regulatory environment that shapes the crypto ecosystem. With a focus on community and cultural impacts, we aim to provide a comprehensive overview that empowers readers to navigate the complexities of the crypto market.

Overview of Cryptocurrency

Cryptocurrency is a revolutionary digital form of currency that operates on a technology called blockchain. This decentralized nature allows for secure transactions without the need for intermediaries, such as banks. The significance of cryptocurrency in modern finance cannot be overstated, as it provides an alternative to traditional financial systems, enabling greater accessibility and financial inclusion for individuals worldwide.The evolution of cryptocurrency began with Bitcoin, created in 2009 by an anonymous person or group known as Satoshi Nakamoto.

Bitcoin introduced the concept of a decentralized currency, leading to the rise of various other cryptocurrencies, most notably Ethereum, which was launched in 2015. Ethereum expanded the capabilities of blockchain technology by introducing smart contracts, enabling automated and self-executing agreements between parties.Decentralized finance (DeFi) has emerged as a significant trend in the crypto space, removing the need for intermediaries in financial transactions.

By leveraging blockchain technology, DeFi offers services such as lending, borrowing, and trading in a peer-to-peer manner, which can democratize access to financial services.

Bitcoin Fundamentals

The technical foundation of Bitcoin lies in blockchain technology, which is a distributed ledger that securely records all transactions across a network of computers. Each block in the blockchain contains a record of transactions and is linked to the previous block, forming a chain that is resistant to tampering.Mining is the process by which new bitcoins are generated and transactions are validated.

Miners use powerful computers to solve complex mathematical problems, which require significant computational power and energy. This process not only secures the network but also influences Bitcoin’s value, as the limited supply of 21 million bitcoins creates scarcity.When comparing Bitcoin with traditional currencies, several advantages emerge. Bitcoin operates independently of central banks, enabling users to transact globally without currency conversion fees.

Additionally, the decentralized nature of Bitcoin provides a level of security and transparency that is often lacking in traditional financial systems.

Ethereum Insights

Ethereum stands out in the crypto ecosystem due to its unique features, particularly smart contracts. These programmable contracts automatically execute actions when predetermined conditions are met, enabling developers to create decentralized applications (dApps) on the Ethereum blockchain.The potential of Ethereum to facilitate dApps is vast, allowing for innovations across various sectors, including finance, supply chain, and gaming. Unlike Bitcoin, which primarily serves as digital gold, Ethereum’s functionality extends beyond currency, making it a versatile platform for developers.Key differences between Ethereum and Bitcoin include their consensus mechanisms and purposes.

While Bitcoin uses proof-of-work for transaction validation, Ethereum is transitioning to proof-of-stake, which promises to be more energy-efficient. Additionally, Bitcoin’s primary focus is on being a store of value, whereas Ethereum aims to be a platform for decentralized applications.

Market Trends and Indicators

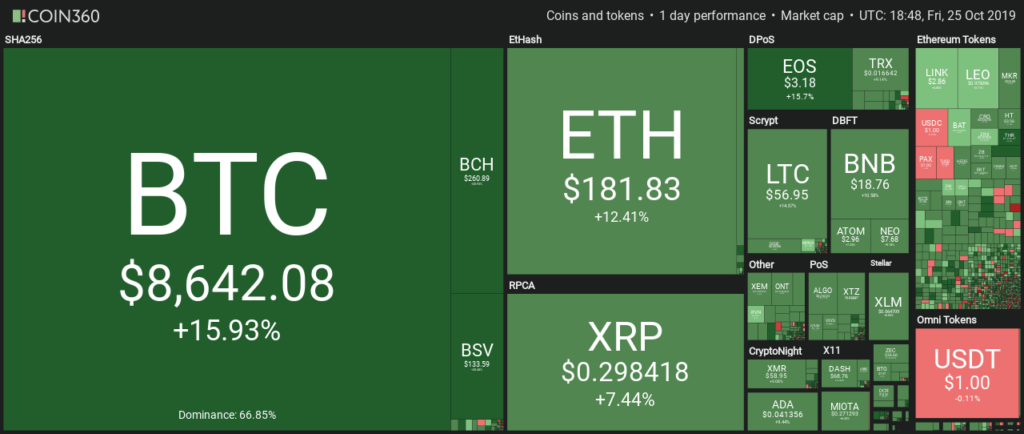

Current trends in the cryptocurrency market are influenced by factors such as technological advancements, regulatory developments, and macroeconomic conditions. The increasing adoption of cryptocurrencies by major financial institutions and corporations has propelled market growth, as more investors seek exposure to this asset class.Investors should monitor key market indicators such as trading volume, market capitalization, and the Bitcoin Fear & Greed Index.

These metrics provide insights into market sentiment and can help guide investment decisions.A historical price data comparison between Bitcoin and Ethereum reveals their respective performance over time. While Bitcoin has been relatively stable as a store of value, Ethereum has experienced significant growth due to its expanding ecosystem of dApps and DeFi projects.

Investment Strategies

Investing in cryptocurrencies requires a well-thought-out strategy. A detailed guide for investors includes understanding market trends, setting investment goals, and conducting thorough research before committing funds. Risk management practices are crucial when investing in crypto. Investors should consider diversifying their portfolios across different cryptocurrencies and maintaining a balanced approach to mitigate potential losses. Utilizing stop-loss orders and setting clear exit strategies can also help manage risk effectively.Portfolio diversification is particularly important in the context of cryptocurrencies, given their high volatility.

Investors should consider including a mix of established cryptocurrencies, like Bitcoin and Ethereum, alongside promising altcoins to spread risk and enhance potential returns.

Regulatory Environment

Global regulations significantly impact the cryptocurrency market. Governments worldwide are grappling with how to regulate crypto assets, aiming to protect consumers while fostering innovation. Jurisdictions that embrace clear regulatory frameworks tend to attract more investment and development.Key governmental policies affecting Bitcoin and Ethereum include those related to taxation, anti-money laundering (AML), and securities regulations. These policies can influence market sentiment and investment decisions, leading to increased volatility in the crypto markets.The relationship between regulatory frameworks and market volatility is complex.

Announcements of new regulations can lead to sharp price fluctuations, as investors react to perceived threats or opportunities within the market landscape.

Future Outlook

The cryptocurrency market is expected to continue evolving over the next five years. Predictions indicate that mainstream adoption will increase, fueled by further technological advancements and integration with traditional financial systems. Potential technological advancements include improvements in scalability and security, which could enhance the usability of both Bitcoin and Ethereum. Innovations such as Layer 2 solutions and cross-chain integrations may address existing limitations and drive further adoption.Expert opinions suggest that the future of cryptocurrencies will involve greater regulatory clarity, which could encourage institutional investment and increase market stability.

As cryptocurrencies become more integrated into everyday financial transactions, their role in the global economy is likely to expand significantly.

Community and Cultural Impact

The role of community in the development and promotion of Bitcoin and Ethereum cannot be overlooked. Strong, engaged communities contribute to the growth of these networks through advocacy, education, and innovation, helping to foster trust and expand user bases.Cryptocurrency adoption has led to notable cultural shifts, including a growing acceptance of decentralized finance and the rise of digital art through non-fungible tokens (NFTs).

These shifts highlight the potential for cryptocurrencies to reshape traditional industries and create new opportunities.Social implications of cryptocurrency are varied across different economies. In regions with limited access to banking services, cryptocurrencies offer a means to participate in the global economy. Conversely, in developed economies, cryptocurrencies are often viewed as speculative investments, affecting perceptions of financial security and investment behavior.

Final Thoughts

In summary, the bitcoin ethereum crypto market analysis offers valuable insights for anyone looking to understand the dynamic world of cryptocurrencies. By examining the fundamentals, market trends, and future outlook, we hope to equip you with the knowledge needed to make informed decisions in this evolving financial frontier.

FAQ Overview

What is the main difference between Bitcoin and Ethereum?

Bitcoin primarily serves as a digital currency, while Ethereum is a platform that enables smart contracts and decentralized applications (dApps).

How can I start investing in cryptocurrencies?

To invest in cryptocurrencies, you can start by creating an account on a reputable exchange, conducting thorough research, and developing a clear investment strategy.

What are the risks involved in cryptocurrency investment?

Cryptocurrency investments are subject to high volatility, regulatory changes, and security risks. It’s essential to perform due diligence and implement risk management strategies.

How does regulation affect the crypto market?

Regulations can impact market stability, investor confidence, and the overall growth of cryptocurrencies, often leading to increased volatility during policy changes.

What future trends should investors watch in the crypto space?

Investors should keep an eye on technological advancements, regulatory developments, and the growth of decentralized finance (DeFi) and non-fungible tokens (NFTs) as they shape the future of the crypto market.