Business Plan Sample Presentation Guide

Crafting a compelling business plan presentation is crucial for securing funding, attracting partners, or simply gaining internal buy-in. This guide delves into the essential elements of a successful presentation, from defining the scope and crafting a narrative to visualizing key data and addressing potential risks. We’ll explore effective storytelling techniques, best practices for visual aids, and strategies for a powerful call to action, ultimately equipping you to create a presentation that resonates with your audience.

Through practical examples and clear explanations, we will navigate the process of structuring your presentation, incorporating relevant financial projections and marketing strategies, and effectively showcasing your management team’s expertise. This comprehensive guide aims to provide a clear framework for creating a persuasive and impactful business plan presentation that leaves a lasting impression.

Defining the Scope of a Business Plan Presentation Sample

A compelling business plan presentation effectively communicates a company’s vision, strategy, and financial projections to its target audience. Its scope encompasses a concise yet comprehensive overview of the business, designed to secure buy-in, investment, or internal approval. The effectiveness hinges on tailoring the content and delivery to the specific audience and their priorities.A successful business plan presentation typically includes key elements such as an executive summary, company description, market analysis, products and services, marketing and sales strategy, management team, financial projections, and funding request (if applicable).

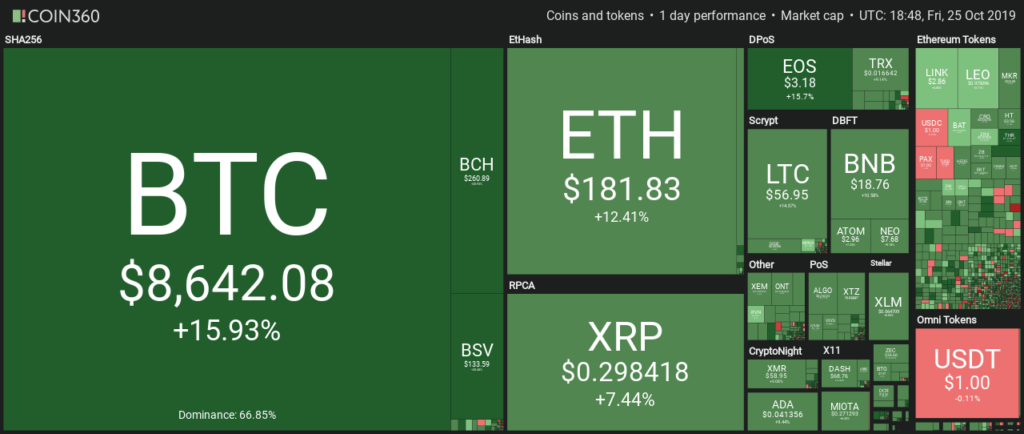

Visual aids like charts, graphs, and images are crucial for enhancing understanding and engagement. The presentation should tell a clear and concise story, highlighting the opportunity, the solution, and the path to success.

Types of Business Plan Presentations

Different audiences require different approaches. A presentation for investors will focus heavily on financial projections, return on investment (ROI), and exit strategies. Lenders, on the other hand, will be primarily interested in the company’s financial health, repayment capacity, and collateral. Internal stakeholders, such as employees or board members, might prioritize strategic alignment, operational efficiency, and risk mitigation.

The level of detail and the emphasis on specific aspects will vary considerably depending on the intended recipient. For instance, an investor presentation might highlight key metrics like projected revenue growth and market share, while a presentation to internal stakeholders might delve deeper into operational plans and resource allocation.

Sample Presentation Structure

A well-structured presentation follows a logical flow. Here’s a sample Artikel:

Executive Summary

This concise overview summarizes the key aspects of the business plan, including the problem, solution, market opportunity, financial highlights, and funding request (if applicable). It should grab the audience’s attention and leave them wanting to learn more.

Company Description

This section provides a detailed overview of the company, its mission, vision, and values. It should clearly articulate the company’s unique selling proposition (USP) and its competitive advantages. This could include information about the company’s legal structure, history, and team.

Market Analysis

This section analyzes the target market, including market size, growth potential, trends, and competitive landscape. It should demonstrate a deep understanding of the market and the company’s ability to capture market share. This might include data on market demographics, consumer behavior, and competitive analysis.

Products and Services

This section details the company’s offerings, highlighting their features, benefits, and value proposition. It should clearly articulate how the products or services solve the identified problem and meet the needs of the target market. This could include images or demonstrations of the products or services.

Marketing and Sales Strategy

This section Artikels the company’s plan to reach its target market, including marketing channels, sales strategies, and customer acquisition costs. It should demonstrate a clear understanding of the marketing landscape and a well-defined plan to achieve sales targets. Examples of marketing strategies might include digital marketing, social media marketing, content marketing, and traditional advertising.

Management Team

This section introduces the key members of the management team, highlighting their experience, skills, and expertise. It should demonstrate the team’s ability to execute the business plan and achieve its goals. This could include brief biographies of key personnel and their relevant experience.

Financial Projections

This section presents the company’s financial projections, including revenue forecasts, expense budgets, and profit and loss statements. It should demonstrate the company’s financial viability and its ability to generate a return on investment. This section often includes key financial metrics such as projected revenue growth, profitability, and cash flow. A realistic scenario analysis, considering best-case, worst-case, and most likely scenarios, would strengthen the presentation’s credibility.

For example, a projection might show a 20% year-over-year revenue growth for the next three years, based on market research and sales projections.

Funding Request (if applicable)

If seeking funding, this section Artikels the amount of funding needed, its intended use, and the proposed equity or debt structure. It should clearly articulate the return on investment for potential investors or lenders. This section might include a detailed breakdown of how the funding will be used, such as for research and development, marketing and sales, or working capital.

Crafting a Compelling Narrative

A compelling narrative is crucial for a successful business plan presentation. It transforms a collection of data into a captivating story that resonates with your audience, making them invested in your vision and increasing the likelihood of securing funding or partnerships. A well-crafted narrative not only presents the facts but also evokes emotion and builds trust.Your narrative should effectively communicate your business’s value proposition – what unique problem you solve and why your solution is superior.

This involves clearly articulating your target market, your competitive advantage, and the potential for significant return on investment. The narrative should guide the audience through your business model, highlighting key milestones and demonstrating a clear path to success.

Storytelling Techniques for Business Plan Presentations

Effective storytelling is more than just presenting facts; it’s about connecting with your audience on an emotional level. Consider using techniques like incorporating personal anecdotes to humanize your business and build credibility. This could involve sharing the origin story of your company, highlighting a significant challenge you overcame, or showcasing the passion that drives your team. Another effective technique is to use vivid imagery and metaphors to paint a picture of your vision for the future.

Instead of simply stating projected growth, describe the impact your business will have on the lives of your customers and the community. For instance, instead of saying “We expect 20% market share in three years,” you could say, “In three years, we envision our product transforming the daily lives of 100,000 families, making their routines easier and more efficient.”

Sample Opening Slide

The opening slide is your first opportunity to make a lasting impression. It should be visually appealing and immediately communicate your business’s core message. A strong opening slide could feature a powerful image representing your business’s core value proposition, accompanied by a concise and impactful headline. For example, if your business is a sustainable food delivery service, the image could be a vibrant photo of fresh, locally sourced produce being delivered to a happy customer.

The headline could be: “Revolutionizing Food Delivery: Fresh, Local, Sustainable.” Subsequent text on the slide could briefly highlight the problem you solve (e.g., lack of access to healthy, locally sourced food) and the key benefit you provide (e.g., convenient access to fresh, healthy food with minimal environmental impact). The overall goal is to capture the audience’s attention and leave them wanting to learn more.

Visualizing Key Data and Metrics

Effective visualization is crucial for presenting financial projections and key performance indicators (KPIs) in a business plan. A well-designed visual aids understanding, highlights key trends, and makes complex data more accessible to your audience. Avoiding data overload is key; focus on the most impactful information to support your narrative.Presenting financial projections and KPIs clearly and concisely requires careful selection of appropriate charts and graphs.

Overly complex visuals can distract from your message, while poorly chosen ones can misrepresent your data. The goal is to create a compelling visual story that complements your verbal presentation.

Financial Projections in Table Format

A clear and concise way to present financial projections is through a well-structured table. The following table illustrates projected revenue, expenses, and profit over three years. This allows investors to quickly grasp the financial health and growth potential of your business. Note that these figures are illustrative examples and should be replaced with your own projections.

| Year | Revenue | Expenses | Profit |

|---|---|---|---|

| Year 1 | $100,000 | $60,000 | $40,000 |

| Year 2 | $150,000 | $75,000 | $75,000 |

| Year 3 | $225,000 | $90,000 | $135,000 |

Best Practices for Visualizations

Using visuals effectively requires careful consideration of several factors. Simplicity is paramount; avoid cluttered charts and graphs that overwhelm the audience. Choose chart types appropriate to the data being presented. Maintain consistency in style and formatting throughout your presentation. Label all axes and data points clearly.

Use a consistent color scheme to enhance readability and avoid visual distractions. Finally, ensure your visuals are high-resolution and easily readable, even from a distance.

Examples of Suitable Charts and Graphs

Different chart types are best suited for different data. For example, a line graph is ideal for showing trends over time, such as revenue growth. A bar chart effectively compares different categories, such as sales across different product lines. Pie charts are useful for showing proportions, such as market share. Scatter plots can illustrate correlations between two variables.

The selection of the chart type should directly relate to the story you are trying to tell with your data. For instance, a startup showcasing user growth over time would benefit from a line graph illustrating the upward trend, while a company comparing sales figures across different regions would utilize a bar chart to facilitate easy comparison. A well-chosen chart not only presents data but also emphasizes key insights, strengthening your narrative.

Addressing Potential Risks and Challenges

No business plan is complete without a thorough assessment of potential risks and challenges. Investors and stakeholders need to understand not only the opportunities but also the potential pitfalls. A well-structured presentation proactively addresses these concerns, demonstrating foresight and a robust plan for mitigation. This builds trust and confidence in your business venture.Presenting potential risks and mitigation strategies requires transparency and credibility.

Avoid downplaying challenges; instead, acknowledge them directly and present realistic solutions. This approach demonstrates a realistic understanding of the business environment and strengthens your credibility. Focusing on proactive mitigation strategies rather than simply listing potential problems highlights your preparedness and problem-solving abilities.

Risk Assessment and Mitigation Strategies

A comprehensive risk assessment involves identifying potential threats to your business, analyzing their likelihood and potential impact, and developing strategies to mitigate those risks. This process should be documented and presented clearly in your business plan presentation. A visual representation, such as a table, can effectively communicate this information.

- Risk: Increased competition from established players. Mitigation: Develop a unique value proposition, focus on niche markets, and build strong brand loyalty through superior customer service and innovative offerings. Example: A new coffee shop could differentiate itself by offering unique blends, a focus on ethically sourced beans, or a unique in-store experience.

- Risk: Economic downturn affecting consumer spending. Mitigation: Develop a flexible pricing strategy, diversify revenue streams, and maintain a lean operating structure to weather economic fluctuations. Example: A restaurant might offer a value menu during economic downturns or introduce catering services to broaden their customer base.

- Risk: Supply chain disruptions. Mitigation: Diversify suppliers, build strong relationships with key suppliers, and maintain sufficient inventory levels to buffer against disruptions. Example: A manufacturing company could establish relationships with multiple component suppliers in different geographic locations to mitigate the risk of supply chain disruptions due to natural disasters or political instability.

- Risk: Failure to attract and retain key personnel. Mitigation: Offer competitive salaries and benefits, create a positive work environment, and invest in employee training and development. Example: A technology startup might offer stock options or profit-sharing to attract and retain talented engineers.

- Risk: Changes in technology rendering products or services obsolete. Mitigation: Invest in research and development, continuously monitor technological advancements, and adapt products and services to meet evolving customer needs. Example: A software company might invest in regular updates and new feature development to stay competitive and relevant.

Business Plan with Marketing Strategies

A well-defined marketing strategy is crucial for the success of any business. Integrating marketing plans seamlessly into the overall business plan ensures that marketing efforts are aligned with broader business objectives, maximizing their impact and return on investment. This section details how to effectively incorporate marketing strategies within your business plan and showcases the importance of this integration.Integrating marketing strategies within a business plan involves more than just adding a separate marketing section; it requires a holistic approach.

The marketing plan should be directly tied to the company’s overall goals, target audience, and competitive landscape. This ensures that all marketing activities are working towards a common objective, rather than operating in isolation. A successful integration ensures that marketing efforts are both strategic and measurable, allowing for adjustments and optimizations along the way.

Marketing Plan Section: Structure and Content

The marketing section of your business plan should clearly articulate your target market, marketing objectives, strategies, tactics, budget, and key performance indicators (KPIs). It should detail how your marketing activities will support the achievement of your overall business goals, such as increased market share, brand awareness, or revenue generation. For example, a startup aiming for rapid growth might focus on digital marketing and social media engagement, while an established business might prioritize brand building through content marketing and strategic partnerships.

This section should be detailed enough to provide a clear roadmap for your marketing activities but concise enough to avoid overwhelming the reader.

Aligning Marketing Strategies with Business Objectives

Alignment between marketing strategies and overall business objectives is paramount. Marketing efforts should directly contribute to the achievement of broader business goals. For instance, if the business objective is to increase market share by 15% within the next year, the marketing strategy should include specific tactics designed to achieve this, such as targeted advertising campaigns, strategic partnerships, or new product launches.

Without this alignment, marketing activities may be ineffective or even counterproductive. Consider Coca-Cola’s consistent brand messaging and global marketing campaigns – these are directly tied to maintaining their market dominance and brand recognition.

Examples of Marketing Strategies and Their Impact

Various marketing strategies exist, each with its potential impact on business growth. The choice of strategy depends on factors such as target market, budget, and business goals.

| Marketing Channel | Description | Potential Impact | Example |

|---|---|---|---|

| Social Media Marketing | Utilizing platforms like Facebook, Instagram, and Twitter to reach and engage target audiences. | Increased brand awareness, lead generation, customer engagement. | A clothing brand using Instagram to showcase new collections and run targeted ads. |

| Email Marketing | Sending targeted emails to nurture leads and promote products or services. | Improved customer relationships, increased sales conversions, targeted promotions. | An e-commerce store sending personalized email recommendations based on past purchases. |

| Content Marketing | Creating and distributing valuable, relevant, and consistent content to attract and retain a clearly defined audience — and, ultimately, to drive profitable customer action. | Enhanced brand authority, increased website traffic, improved search engine rankings. | A software company publishing blog posts and case studies to educate potential customers. |

| Search Engine Optimization () | Optimizing website content and structure to improve organic search engine rankings. | Increased website traffic, improved brand visibility, cost-effective lead generation. | A local bakery optimizing its website for local search terms like “best bakery near me”. |

Business Plan with Financial Projections

Creating realistic financial projections is crucial for securing funding and guiding your business’s growth. A well-structured financial forecast demonstrates your understanding of the market, your operational efficiency, and your potential for profitability. This section will Artikel the key financial statements and provide a sample projection.Financial projections are more than just numbers; they’re a roadmap for your business’s financial future.

They help you anticipate cash flow needs, identify potential bottlenecks, and make informed decisions about resource allocation. Accurate projections increase your credibility with investors and lenders, making it easier to secure the capital necessary to launch and grow your business. Without robust financial projections, your business plan lacks a critical element of credibility and strategic planning.

Key Financial Statements

The three core financial statements – the income statement, balance sheet, and cash flow statement – provide a comprehensive overview of your business’s financial health. Understanding each statement and their interrelationships is essential for effective financial planning.The income statement, also known as the profit and loss statement, shows your revenue, expenses, and resulting profit or loss over a specific period.

It summarizes your business’s financial performance. The balance sheet provides a snapshot of your business’s assets, liabilities, and equity at a specific point in time. It shows what your business owns, what it owes, and the value of the owners’ investment. The cash flow statement tracks the movement of cash into and out of your business over a specific period.

It shows how much cash you have on hand, where it’s coming from, and where it’s going. These statements are interconnected; changes in one statement impact the others. For example, a profitable income statement (more revenue than expenses) will generally increase your equity on the balance sheet and improve your cash flow.

Projected Income Statement Example

Let’s consider a hypothetical example of a small bakery, “Sweet Success,” for the first three years of operation. This example uses simplified figures for illustrative purposes and should not be taken as financial advice. Real-world projections require far more detailed market research and operational cost analysis.

| Year | Revenue | Cost of Goods Sold | Gross Profit | Operating Expenses | Net Income |

|---|---|---|---|---|---|

| Year 1 | $50,000 | $20,000 | $30,000 | $25,000 | $5,000 |

| Year 2 | $75,000 | $30,000 | $45,000 | $30,000 | $15,000 |

| Year 3 | $100,000 | $40,000 | $60,000 | $35,000 | $25,000 |

This projected income statement shows a steady increase in revenue and net income over the three years, reflecting anticipated growth in customer base and operational efficiency. Note that these are projections; actual results may vary. The key is to demonstrate a reasonable and well-supported basis for these projections. For example, the revenue projections should be based on market research, pricing strategies, and sales forecasts.

Similarly, cost of goods sold and operating expenses should reflect realistic estimates based on anticipated production volume, supplier costs, and staffing levels. A detailed explanation of the assumptions underlying these projections should accompany the financial statements. This explanation adds crucial context and demonstrates your thoroughness in developing the financial plan.

Business Plan with Management Team

A strong management team is crucial for a successful business. Investors and lenders will scrutinize this section carefully, looking for evidence of experience, expertise, and the ability to execute the business plan. Effectively presenting your team’s capabilities can significantly increase your chances of securing funding and building confidence in your venture. The presentation should showcase not only individual skills but also the synergistic effect of the team working together.The importance of highlighting the team’s strengths and capabilities in achieving business goals cannot be overstated.

A cohesive and competent management team inspires confidence, demonstrating to potential investors and stakeholders that the business is in capable hands. Their collective experience and skills directly impact the likelihood of successfully navigating challenges, capitalizing on opportunities, and ultimately achieving the projected financial outcomes Artikeld in the business plan. This section should clearly articulate how each team member contributes to the overall success of the business.

Team Member Biographies

The following are brief biographies of three hypothetical team members, showcasing their relevant skills and experience. These examples illustrate the type of information that should be included for each member of your actual management team.

Sarah Chen: Chief Executive Officer

Sarah Chen brings over 15 years of experience in the technology sector to her role as CEO. Her background includes 8 years as a senior product manager at a leading software company, where she successfully launched several innovative products that achieved significant market share. Before that, she spent 7 years in various engineering roles, developing a deep understanding of the technical challenges and opportunities within the industry.

Sarah holds an MBA from Stanford University and a Bachelor of Science in Computer Engineering from UC Berkeley. Her leadership skills are complemented by her strong analytical abilities and proven track record of building high-performing teams.

David Lee: Chief Financial Officer

David Lee is a seasoned financial professional with more than 12 years of experience in financial planning, analysis, and management. He has a proven ability to develop and implement effective financial strategies that drive profitability and sustainable growth. Prior to joining the company, David served as the CFO of a rapidly growing startup, where he successfully secured several rounds of funding and oversaw the company’s financial operations during a period of significant expansion.

He holds a CPA license and an MBA from the University of Chicago, along with a Bachelor of Science in Accounting from UCLA. His expertise in financial modeling and forecasting will be instrumental in guiding the company’s financial trajectory.

Maria Garcia: Chief Marketing Officer

Maria Garcia is a highly creative and results-oriented marketing executive with 10 years of experience in developing and implementing successful marketing campaigns. Her expertise spans digital marketing, social media strategy, and brand building. In her previous role at a major consumer goods company, she led the marketing efforts for a product launch that exceeded all sales projections. Maria holds a Bachelor of Arts in Marketing from NYU and a Master’s degree in Digital Marketing from Columbia University.

Her innovative approach to marketing and her deep understanding of consumer behavior will be essential in building brand awareness and driving customer acquisition.

Final Summary

In conclusion, a well-structured and engaging business plan presentation is more than just a collection of data; it’s a compelling narrative that showcases your vision, strategy, and potential for success. By focusing on clear communication, impactful visuals, and a strong call to action, you can effectively convey your business’s value proposition and inspire confidence in your audience. Remember, the key to a successful presentation lies in understanding your audience and tailoring your message to resonate with their specific needs and interests.

With careful planning and execution, your business plan presentation can become a powerful tool for achieving your goals.

FAQ

What is the ideal length for a business plan presentation?

The ideal length depends on your audience and context. Aim for a concise and focused presentation, typically between 15-20 minutes for investor pitches and potentially longer for internal presentations.

How do I handle tough questions from investors during the Q&A?

Prepare for challenging questions by anticipating potential concerns. Maintain composure, listen carefully, and answer honestly and directly. If unsure, acknowledge the question and offer to follow up with a more detailed response.

What software is best for creating a business plan presentation?

Popular choices include PowerPoint, Google Slides, and Keynote. Select the software you’re most comfortable using to create a visually appealing and easy-to-navigate presentation.