Bitcoin Eth Altcoins Rally Potential In The Market

Bitcoin eth altcoins rally potential sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

The cryptocurrency market has been experiencing a dynamic phase, with Bitcoin and Ethereum leading the charge while altcoins show promising signs of growth. As investors navigate the fluctuating landscape, understanding the historical performance of these digital currencies becomes essential. This overview will delve into the factors that influence their movements and the potential for rallies that could reshape the market.

Overview of the Cryptocurrency Market

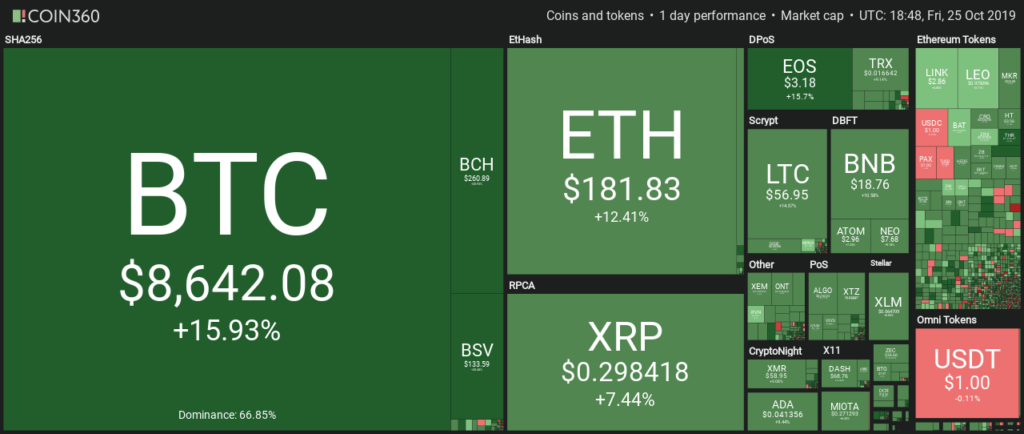

The cryptocurrency market has seen significant fluctuations, with Bitcoin and Ethereum maintaining their positions as the dominant players. As of now, Bitcoin continues to command the largest market capitalization, while Ethereum has solidified its status as a leading blockchain platform for decentralized applications. Altcoins have also gained traction, reflecting a growing diversity in the market. Historical performance indicates that Bitcoin has often led the charge during bull markets, influencing altcoin trends and investor sentiment.

Recently, the overall atmosphere is marked by a cautious optimism as regulatory developments and institutional interest shape market dynamics.

Current State of Bitcoin, Ethereum, and Altcoins

Bitcoin's historical performance shows a pattern of leading price movements that often dictate the trends for altcoins. Ethereum consistently follows as a close second, providing a strong technological framework that other altcoins often rely on. Investor sentiment has shifted positively in response to network upgrades and the increasing adoption of cryptocurrencies in mainstream finance. Market trends indicate that while Bitcoin often experiences the most volatility, altcoins can present unique opportunities for gains during bullish phases.

Historical Performance of Bitcoin and Ethereum

Bitcoin's historical rallies have set precedence for many altcoins. For instance, during the 2017 bull run, Bitcoin surged over 1,000%, pulling many altcoins along with it. Ethereum, while also experiencing substantial growth, has displayed a relatively stable trajectory, innovating its platform to attract developers and projects. The correlation between Bitcoin and altcoins remains significant, as shifts in Bitcoin’s value frequently lead to fluctuations in altcoin prices.

Market Trends and Investor Sentiment

The current market sentiment is characterized by cautious optimism, driven by factors such as increased institutional investment and technological advancements within blockchain platforms. Social media sentiment analysis shows a rising inclination towards positive narratives surrounding Bitcoin and Ethereum, which could enhance interest in altcoins as well. As the market evolves, trends indicate that investors are becoming more sophisticated, seeking projects with real-world utility and strong development teams.

Bitcoin's Role in Market Dynamics

Bitcoin serves as the benchmark for the overall cryptocurrency market. Its price movements often dictate the fate of altcoins, creating a ripple effect across the market. In previous rallies, Bitcoin has demonstrated a leadership role, leading to a phenomenon where altcoins surge shortly after significant Bitcoin price increases.

Influence of Bitcoin on Altcoin Pricing

Bitcoin's dominance in the market means that its price fluctuations directly impact the pricing of altcoins. For example, when Bitcoin sees a substantial increase in value, altcoins tend to follow suit, experiencing gains as investors shift their focus towards these alternatives. The interdependence of Bitcoin and altcoins is a crucial aspect of market dynamics.

Comparative Analysis of Bitcoin's Market Behavior

In comparing Bitcoin's market behavior during past rallies to its current performance, similarities are evident. Bitcoin often reaches a peak followed by a consolidation phase, after which altcoins tend to experience their own rallies. The present market environment shows a mix of historical patterns and new influences, such as global economic conditions and regulatory changes.

Factors Contributing to Bitcoin’s Rally Potential

Several factors contribute to Bitcoin's potential for future rallies, including:

- Increased institutional adoption and investment

- Technological advancements in scalability and security

- Global economic uncertainties prompting interest in alternative assets

- Positive regulatory developments fostering a healthier market environment

Ethereum and Its Innovations

Ethereum stands out not only as a cryptocurrency but also as a platform fostering innovation through its blockchain technology. Its advancements have positioned it favorably for potential price rallies, particularly as Ethereum 2.0 introduces significant upgrades.

Technological Advancements of Ethereum

Ethereum's transition to a proof-of-stake model is one of its most significant innovations. This not only enhances network security but also improves energy efficiency, making it more attractive to environmentally conscious investors. Additionally, the introduction of Layer 2 solutions is set to increase transaction speeds and reduce costs, further cementing its place in the market.

Ethereum-based Projects and Market Impact

Numerous Ethereum-based projects have gained traction, contributing positively to the overall ecosystem. Projects like Uniswap and Chainlink have shown substantial growth, showcasing the utility of Ethereum's smart contract capabilities. These projects not only enhance Ethereum's value but also have a ripple effect on investor interest in the broader altcoin market.

Implications of Ethereum 2.0 Transition

The transition to Ethereum 2.0 carries significant implications for its performance and the dynamics among altcoins. With enhanced scalability and lower transaction fees, Ethereum is expected to attract more developers and users, increasing its market dominance. This, in turn, could lead to a stronger performance for altcoins built on the Ethereum network.

Altcoins and their Market Potential

While Bitcoin and Ethereum dominate the market, numerous altcoins show potential for growth. Identifying these emerging players can provide investors with lucrative opportunities.

Key Altcoins with Growth Potential

Several altcoins exhibit promising growth alongside Bitcoin and Ethereum:

- Cardano (ADA): Known for its strong community and innovative technology.

- Solana (SOL): Recognized for its high throughput and low transaction costs.

- Polkadot (DOT): Focused on interoperability between different blockchains.

- Chainlink (LINK): A leading oracle solution that enhances smart contracts.

Comparative Analysis of Altcoins

A comparative analysis of these altcoins reveals varying strengths:

| Altcoin | Market Capitalization | Utility | Developer Activity |

|---|---|---|---|

| Cardano | High | Smart contracts, decentralized applications | Active |

| Solana | High | High-speed transactions | Growing |

| Polkadot | Moderate | Interoperability | Active |

| Chainlink | Moderate | Data feeds for smart contracts | Very Active |

Factors Leading to Increased Investor Interest in Altcoins

Factors contributing to rising investor interest in altcoins include:

- Innovative technology and unique use cases

- Strong community support and developer engagement

- Potential for higher returns compared to established cryptocurrencies

Factors Influencing Rally Potential

The cryptocurrency market is influenced by various factors that can affect prices. Understanding these can help investors navigate potential rallies effectively.

Macroeconomic Factors Affecting Cryptocurrency Prices

Macroeconomic factors play a crucial role in shaping the cryptocurrency landscape. Issues such as regulatory changes, inflation rates, and global economic stability can impact investor sentiment and price movements. For instance, positive regulatory news can lead to increased market confidence, while negative news can create panic selling.

Technical Indicators for Predicting Rally Potential

Traders often rely on technical indicators to gauge rally potential. Some popular indicators include:

- Moving averages (MA)

- Relative strength index (RSI)

- Bollinger Bands

- Volume indicators

Role of Social Media and News in Influencing Cryptocurrencies

Social media and news outlets play a significant role in shaping public perception and investor sentiment in the cryptocurrency market. Viral trends or influential endorsements can spark rapid price movements, highlighting the importance of staying informed through reliable news sources.

Strategies for Investors

Investors looking to capitalize on potential rallies in Bitcoin, Ethereum, and altcoins can benefit from adopting clear strategies.

Guide for Investors Capitalizing on Rallies

A strategic approach involves:

- Conducting thorough research on projects and market trends

- Diversifying investments across multiple cryptocurrencies

- Setting clear entry and exit points for trades

Risk Management Techniques for Volatile Markets

Risk management is crucial in volatile markets. Techniques include:

- Using stop-loss orders to limit potential losses

- Allocating only a portion of the portfolio to high-risk investments

- Regularly reviewing and adjusting the investment strategy

Overview of Investment Vehicles for Cryptocurrency Investments

Investors have various options for investing in cryptocurrencies, including:

- Exchange-traded funds (ETFs): Providing exposure to multiple cryptocurrencies.

- Futures contracts: Allowing traders to speculate on future price movements.

- Direct buying through exchanges: Enabling straightforward ownership of cryptocurrencies.

Wrap-Up

In conclusion, the interplay between Bitcoin, Ethereum, and altcoins underscores the evolving nature of the cryptocurrency market. As technical advancements and macroeconomic factors come into play, the potential for a rally remains high, inviting investors to explore opportunities. Staying informed and strategic will be key for those looking to capitalize on the momentum of these digital assets.

Top FAQs

What factors influence Bitcoin's price movements?

Factors include market sentiment, regulatory developments, and macroeconomic trends.

How does Ethereum 2.0 affect its rally potential?

Ethereum 2.0 introduces scalability and efficiency improvements, enhancing its attractiveness to investors.

What are the risks associated with investing in altcoins?

Risks include high volatility, lack of regulation, and the potential for project failures.

How can social media impact cryptocurrency prices?

Social media can amplify news and trends, influencing investor behavior and market movements.

What strategies should investors consider for cryptocurrency?

Investors should focus on diversification, thorough research, and risk management techniques.