Bitcoin Ethereum Xrp Comeback Altcoins Opportunity

Bitcoin ethereum xrp comeback altcoins opportunity sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

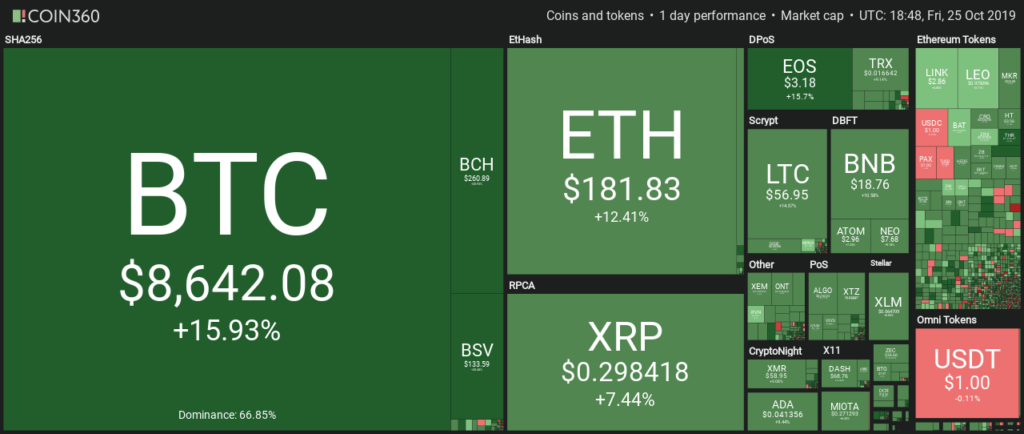

The cryptocurrency market is witnessing a notable shift, with Bitcoin, Ethereum, and XRP taking center stage amid evolving dynamics. Recent trends show a surge in interest for altcoins, driven by both technological advancements in blockchain and the influence of institutional investments. As we delve into these developments, we’ll explore how historical patterns are shaping current market sentiments and what this means for the future of these digital assets.

Overview of Cryptocurrency Market Trends

The cryptocurrency market has experienced significant fluctuations over the past few years, affecting the dynamics of major players like Bitcoin, Ethereum, and XRP. A combination of regulatory developments, technological advancements, and macroeconomic factors has influenced these cryptocurrencies' performance. The recent surge in interest for altcoins can be attributed to a growing acceptance of digital assets, increased retail participation, and innovative projects gaining traction within the crypto community.Historically, market sentiments have been shaped by cycles of speculation and adoption, where periods of growth often lead to increased investments in alternative cryptocurrencies.

As Bitcoin's dominance wanes slightly, many investors are exploring the potential of emerging altcoins, thus creating a budding opportunity for diversification in their portfolios.

Bitcoin's Position in the Market

Bitcoin has maintained its status as the leading cryptocurrency, showing resilience in its market performance over the past year. Despite experiencing volatility, Bitcoin's price has seen a notable recovery, driven by renewed interest from institutional investors who recognize its potential as a store of value. Major financial institutions and hedge funds have increased their allocations towards Bitcoin, signaling confidence in its long-term viability.When comparing Bitcoin's stability to that of emerging altcoins, it's evident that Bitcoin’s established network effects and security protocols provide a level of reliability that many new entrants lack.

This stability can be attractive for risk-averse investors, making Bitcoin a preferred choice for those looking to enter the cryptocurrency space.

Ethereum's Technological Advancements

Ethereum has undergone significant upgrades, particularly with the transition to Ethereum 2.0, which aims to enhance scalability and energy efficiency. These improvements are expected to positively impact Ethereum's market value, as they position the platform to better handle increased demand for decentralized applications and smart contracts.Smart contracts are a key differentiator for Ethereum compared to Bitcoin and XRP. They enable automated execution of agreements without intermediaries, fostering innovation within various sectors, including finance, supply chain, and gaming.

Given its pivotal role in the decentralized finance (DeFi) ecosystem, Ethereum has the potential to lead the charge in redefining traditional financial systems.

XRP and Regulatory Challenges

XRP has faced several regulatory hurdles, particularly stemming from its classification as a security by the SEC, which has led to uncertainty regarding its future. These challenges have significant implications for XRP’s price trajectory, affecting investor sentiment and market confidence. The resolution of regulatory issues will be crucial for XRP to regain its standing in the market.In terms of cross-border transactions, XRP offers advantages over Bitcoin and Ethereum, particularly in terms of transaction speed and costs.

Its unique consensus mechanism allows for rapid processing, making it an attractive option for financial institutions looking to enhance payment efficiency.

The Resurgence of Altcoins

The altcoin market has been revitalized with numerous promising projects emerging as attractive investment opportunities. These altcoins are often characterized by innovative use cases, strong development teams, and active communities. A few notable examples include:

- Cardano (ADA)

-Known for its strong focus on sustainability and peer-reviewed research. - Solana (SOL)

-Renowned for its high throughput and low transaction fees, appealing for decentralized applications. - Polkadot (DOT)

-Focuses on interoperability between different blockchains, enhancing connectivity across platforms.

Evaluating the potential of altcoins in the current market necessitates a careful analysis of factors such as technological innovation, community engagement, and market trends. Success stories of altcoins like Chainlink (LINK) and Uniswap (UNI) illustrate how they thrived even during market downturns, emphasizing the importance of fundamental strength and utility.

Investment Strategies in Cryptocurrencies

Investing in cryptocurrencies requires a strategic approach to diversify a portfolio effectively. A comprehensive guide might include:

- Assessing risk tolerance and setting clear investment goals.

- Diversifying across different asset classes, including Bitcoin, Ethereum, and various altcoins.

- Utilizing dollar-cost averaging to mitigate the impact of volatility.

Effective risk management is vital in the crypto space, where price swings can be substantial. Monitoring portfolio performance through analytics platforms and staying updated on market news will contribute to informed decision-making.

Future Predictions for Major Cryptocurrencies

Experts offer varied forecasts for Bitcoin, Ethereum, and XRP over the next five years, with many anticipating continued growth driven by institutional adoption and technological advancements. Bitcoin may solidify its status as a digital gold, while Ethereum could expand its influence in the DeFi space. Meanwhile, XRP's future heavily depends on regulatory resolutions, which could either bolster or hinder its adoption.The long-term potential of Bitcoin versus altcoins remains a topic of debate, with many analysts suggesting that while Bitcoin may serve as a foundational asset, innovative altcoins could present unique opportunities for substantial gains.

Emerging technologies, such as layer-2 solutions and advancements in blockchain interoperability, are expected to significantly impact future cryptocurrency prices.

Community and Ecosystem Development

Community engagement plays a crucial role in the growth and sustainability of cryptocurrencies. Active participation from users, developers, and stakeholders fosters a robust ecosystem, which can drive a coin's success. The collaboration seen in projects like Ethereum and its developer community highlights how collective efforts can lead to technological advancements and broad adoption.Successful community-led projects often demonstrate how grassroots initiatives can thrive.

The growth of decentralized autonomous organizations (DAOs) exemplifies the power of community-driven efforts to shape the future of finance and governance within the crypto space. By harnessing community support, these projects can innovate and adapt effectively to user needs and market demands.

Summary

In summary, the landscape of cryptocurrency is ever-changing, with Bitcoin, Ethereum, and XRP positioned for potential comebacks as altcoins gain traction. Understanding market trends, technological advancements, and regulatory challenges will be crucial for investors looking to navigate this space wisely. As we move forward, the stories of resilience and opportunity within this vibrant ecosystem will continue to unfold, inviting us to be a part of this exciting journey.

FAQ Corner

What are the main factors driving Bitcoin's value?

Bitcoin's value is primarily driven by supply and demand dynamics, institutional investment interest, and its perceived status as a digital gold.

How do Ethereum's upgrades affect its market position?

Ethereum's upgrades, particularly its transition to proof-of-stake, enhance scalability and reduce energy consumption, thereby improving its competitiveness in the market.

What are the risks of investing in altcoins?

Investing in altcoins carries risks such as high volatility, regulatory uncertainties, and the possibility of project failures, making thorough research essential.

Can XRP recover from regulatory challenges?

Yes, if XRP successfully navigates its regulatory challenges, it could see a significant rebound in value and usage in cross-border transactions.

What should investors consider when diversifying their crypto portfolio?

Investors should consider factors like market capitalization, the technology behind the coins, historical performance, and the overall risk profile of each asset.